The ABCs of bookkeeping

In today’s digital times, you’re probably used to having unrivalled access to your financial numbers, key performance indicators (KPIs) and cashflow metrics. Without good bookkeeping, the speed and quality of your reporting can quickly fall down.

So, why is fast and accurate bookkeeping so important? And what are the main bookkeeping tasks that your business should be getting right?

The financial importance of good bookkeeping

Bookkeeping is a fundamental part of your financial process as a business. Without it, your accounting software has no financial data to work with, your FD doesn’t have the most current numbers, and your accountant can’t see the current financial health of the business.

Inputting your financial transaction into some form of record-keeping system is also a mandatory commitment if you’re a registered business and paying goods and services or value-added tax. Bookkeeping is what provides you with a historic breadcrumb trail of your finances – allowing you to track your cashflow, revenues and profits over a given period.

How to maximise your bookkeeping

So, bookkeeping is a vital part of your financial management. And the key to having your transactions recorded, available for reporting and accessible whenever you need them.

But how should the bookkeeping process work, in an ideal world? Let’s walk through the core bookkeeping steps and how you can get the most from this financial admin task.

To keep on top of your bookkeeping:

- Scan all financial paperwork – the initial part of the bookkeeping process is to scan and record all receipts, invoices and remittances. This gives you a digital copy of the paperwork that relates to your income and expenses – important when you get around to filing tax returns and expense claims etc.

- Record all transactions immediately – getting your transaction recorded and in the books ASAP is vital. This includes recording both your income and expenses, as soon as they occur, and matching them with the scanned paperwork. This not only helps you stay organised but also means your financial data is always up-to-date and can provide real-time reporting and numbers. This can be a huge help when running the business.

- Categorise transactions accurately – when recording transactions, make sure you’re accurate and categorise each item correctly. Not only does this remove the potential for errors and miss-keying in your books, it also helps you track your spending and income more accurately, so your reports are an honest reflection of your financial health.

- Reconcile your accounts regularly – reconciliation is the process of matching your transactions (both income and expenses) against your bank statement and other financial statements. It’s a key part of your bookkeeping and should be done regularly, to ensure that your balances are correct and that your records are totally up to date.

- Use a cloud-based accounting system – bookkeeping doesn’t involve books (ledgers, in accounting-speak) anymore. In the digital world, you can use cloud-based accounting software, like Xero, to record your transactions and access your financial data in the cloud from anywhere, at any time. This makes it easier to keep on top of your numbers when out of the office (and Xero will even automate the reconciliation process too).

- Outsource your bookkeeping to a professional – yes, you can do your own bookkeeping. But there’s a LOT of value to delegating all the hard work to a professional bookkeeper. If you don’t have the time or expertise to manage your bookkeeping yourself, outsourcing is a smart move. A bookkeeper will make sure your books are always accurate and under control. Plus, they can produce cashflow statements, revenue forecasts and other reports to help your business decision-making.

Talk to us about outsourcing your booking

With today’s cloud accounting software, bookkeeping is a far less tedious task than it used to be. But it’s still a regular, time-consuming job that can take you away from running the business.

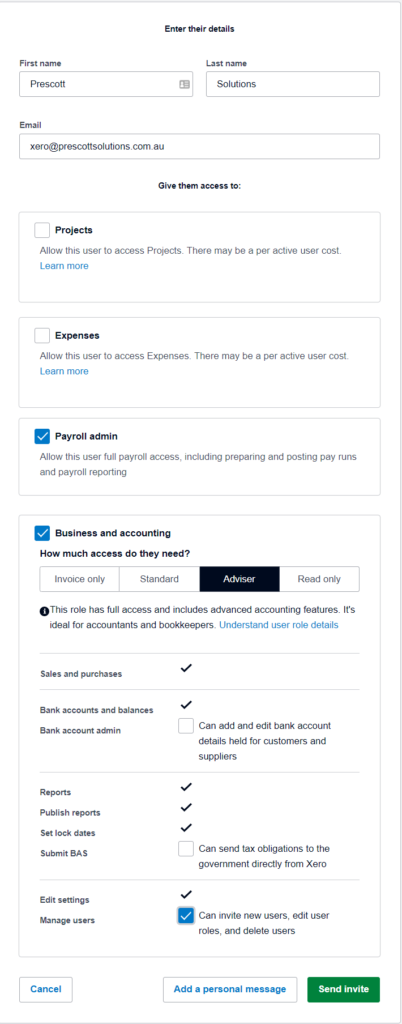

If you’re thinking about outsourcing your bookkeeping, and freeing up that admin time, we’d love to talk to you. Our outsourced bookkeeping service will take on your bookkeeping tasks, to streamline the whole process. We’ll also introduce you to automated data-entry tools like Dext Prepare, Auto Entry and Hubdoc, that make snapping receipts and scanning invoices a breeze.

Let us do the books, so you can get back to talking to customers and winning work.

Contact us today on 08 6118 6111 or hello@prescottsolutions.com.au to discuss more!