2020 Economic Response to the Coronavirus Update

In an announcement on 22 March 2020, the Federal Government has released a second set of measures described as an economic response to the deteriorating outlook due to the Covid-19 virus. This announcement is in addition to the announcement made on the 12th March and is an extension of those initial announcements – combined with our previous actions, bringing to the total to $189 billion, representing 9.7 per cent of annual GDP.

A summary of the key measures are below.

Boosting Cash Flow For Employers

The Government is providing up to $100,000 for eligible small and medium-sized businesses, and not for-profits (NFPs) that employ people, with a minimum payment of $20,000.

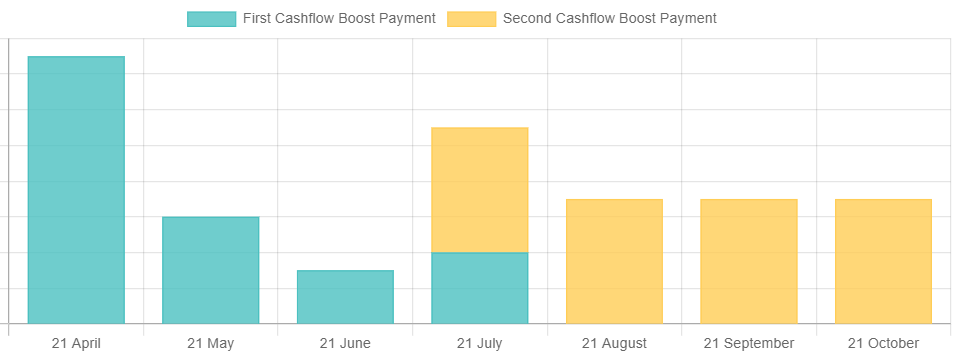

The Tax Free Payments will be made between April and October 2020, with the first payment after the lodgement of the March BAS. Here’s how will it work;

Quarterly lodgers

For the March and June BAS, you will receive 100% of the PAYG Withheld, up to a maximum of $50,000. Each employer will receive a minimum of $10,000 irrespective of their PAYG withholding amount.

An additional payment equal to the total amount withheld as calculated above, will be paid in two equal instalments in July and October.

Monthly Lodgers

For the March monthly BAS, you will receive 300% of the PAYG withholding up to a maximum of $50,000. Each employer will receive a minimum of $10,000 irrespective of their PAYG withholding amount.

For the April, May & June BAS, you will continue to receive 100% of the Tax Withheld, up to a total of $50,000.

An additional payment equal to the total amount withheld as calculated above, will be paid in four equal instalments in July, August, September and October.

Eligibility Criteria

- Turnover under $50 million and that employ workers are eligible.

- The payments will be based on the tax that employers withhold on behalf of their employees and remit to the ATO as PAYG (W).

- The ATO will deliver the payment as a credit to the entity upon lodgment of their activity statements.

- If this places the entity in a refund position, the ATO will deliver the refund within 14 days.

- The payments will only be available to active eligible employers established prior to 12 March 2020

Important: The assistance will only apply to the Tax Withholding. Superannuation still needs to be paid within 28 days after the end of each quarter

Our good friends at Digit Business have built a great tool to estimate the credit available. Check it out here – PAYG Cashflow Boost Calculator

Supporting apprentices and trainees

The Government is supporting small business to retain their apprentices and trainees. Eligible employers can apply for a wage subsidy of 50% of the apprentice’s or trainee’s wage for 9 months from 1 January 2020 to 30 September 2020.

Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer that employs that apprentice. Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter).

Eligibility Criteria

The subsidy will be available to small businesses employing fewer than 20 full-time employees who retain an apprentice or trainee. The apprentice or trainee must have been in training with a small business as at 1 March 2020.

Employers of any size and Group Training Organisations that re-engage an eligible out-of-trade apprentice or trainee will be eligible for the subsidy.

Employers will be able to access the subsidy after an eligibility assessment is undertaken by an Australian Apprenticeship Support Network (AASN) provider.

Accelerated Depreciation

- The Instant asset threshold will increase from $30,000 to $150,000 for equipment purchases such as Truck, Machinery purchased up until 30 June 2020 and can be new or used equipment

- Businesses will be able to deduct 50% of the asset cost in the year of purchase, with the balance being depreciated as normal. This will apply for equipment purchases up until 30 June 2021 and is only for NEW equipment

Both these measures start 12 March 2020 for Businesses with a turnover of less than $500 million.

Temporary Relief for financially distressed businesses

The Government is temporarily increasing the threshold at which creditors can issue a statutory demand on a company and the time companies have to respond to statutory demands they receive.

Not responding to a demand within the specified time creates a presumption that the company is insolvent. The statutory timeframe for a company to respond to a statutory demand will be extended temporarily from 21 days to six months. This will apply for six months.

For owners or directors of a business that are currently struggling due to the Coronavirus, the ATO will tailor solutions for their circumstances, including temporary reduction of payments or deferrals, or withholding enforcement actions including Director Penalty Notices and wind-ups.

If you are concerned about your cashflow, please contact our office immediately to discuss further options

Supporting the Flow of Credit

The Government will provide a guarantee of 50% to small business lenders for new unsecured loans to be used for working capital. This will enhance these lenders’ willingness and ability to provide credit, which will result in small businesses being able to access additional funding to help support them through the upcoming months.

The Government will provide eligible lenders with a guarantee for loans with the following terms:

- Maximum total size of loans of $250,000 per borrower.

- The loans will be up to three years, with an initial six month repayment holiday.

- The loans will be in the form of unsecured finance, meaning that borrowers will not have to provide an asset as security for the loan.

Most banks are also providing options to ‘pause’ mortgage repayments on Home Loans to assist with cashflow.

Update: The Banks have started rolling out their packages for Small Business Loans. Here are some links for more information;

- ANZ – https://www.anz.com.au/business/covid-19/

- Bankwest – https://www.bankwest.com.au/help/coronavirus-support

- Commonwealth Bank – https://www.commbank.com.au/latest/coronavirus

- NAB – https://www.nab.com.au/personal/customer-support/covid19-help/business-support

- Westpac – https://www.westpac.com.au/help/disaster-relief/coronavirus/

Supporting Individuals and Households

Income support for individuals

Existing and new recipients of the following Centrelink payments will receive an additional $550 per fortnight to supplement their payments:

- Job Seeker Payment

- Youth Allowance Jobseeker

- Parenting Payment

- Farm Household Allowance;

- Special Benefit

Income support recipients could benefit from:

- A reduction in social support deeming rates, and/or;

- Two separate $750 payments made in March and July this year

Temporary early release of superannuation

Individuals such as casual workers and sole traders whose income is adversely affected by 20% or more due to the coronavirus pandemic will be able to access up to $10,000 by 30 June 2020 from their superannuation fund. This due to a temporary change to the release conditions allowing these ‘early release’ payments, and an additional $10,000 in the next financial year.

Eligibility

To apply for early release you must satisfy any one or more of the following requirements:

- you are unemployed; or

- you are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or

- on or after 1 January 2020:

- you were made redundant; or

- your working hours were reduced by 20% or more; or

- if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20% or more.

People accessing their superannuation will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

Next steps

With the economic uncertainty and a range of new benefits available, being proactive and planning now could make a big difference to your business. Be open, and speak to your team regularly about what would happen if your business needs to close due to Coronavirus/ Covid-19. Above all, support each other as much as possible – we are all in this together.

For further information about how the new measures may assist you or your business, please contact us at Prescott Business Solutions on 08 6118 6111 or hello@prescottsolutions.com.au.

More Information

- https://treasury.gov.au/coronavirus/businesses

- https://www.ato.gov.au/General/New-legislation/The-Australian-Government-s-Economic-Response-to-Coronavirus/

- https://www.fairwork.gov.au/about-us/news-and-media-releases/website-news/coronavirus-and-australian-workplace-laws

- https://www.ato.gov.au/Individuals/Dealing-with-disasters/In-detail/Specific-disasters/COVID-19